The most important thing in brief

-

Types of Investments: Investing is a

way to build wealth. Options include securities,

tangible assets (like real estate or classic cars), and

bank deposits such as daily or fixed-term accounts.

-

Investment Duration: Investments can be

categorized as short-, medium-, or long-term. The best

investment horizon depends on individual financial

goals.

-

Finding the Right Investment: Investors

can identify the best investment option by defining

their goals, estimating required capital, and assessing

their risk tolerance.

Overview: All in-depth articles on investing are just a

click away

What Is an Investment?

An investment includes all accounts or financial instruments

that may gain or lose value through price increases,

appreciation over time, or interest earnings. Investments range

from financial instruments like stocks, mutual funds, or ETFs to

tangible assets such as collectibles, gold and silver, classic

cars, or real estate.

In theory, interest-bearing savings accounts are also considered

investments. However, especially in Germany, savings accounts

and passbooks generate little to no interest and rarely produce

gains. That’s why, at Allianz, they are categorized under

"saving" rather than as an investment for building wealth.

Risk notice:

Every investment in the capital market involves both

opportunities and risks. The value of investments may rise or

fall. In the worst-case scenario, a total loss of the invested

amount may occur. You can find detailed information under

Risk Notices.

What Investment Options Are Available?

There are various ways investors can invest their money. Bonds,

stocks, mutual funds, and ETFs or index funds are among the most

common. Before deciding which option is best for you, it can be

helpful to directly compare the different types of investments.

| Asset Class |

Description |

Transparency / Comprehensibility |

| Stocks (Standard Securities) |

Certified shares of companies, forming the foundation of

any investment portfolio.

|

High transparency, easy to understand. |

| Bonds (Standard Securities) |

Interest-bearing securities that entitle the holder to

repayment of capital plus interest.

|

High transparency, easy to understand. |

| Index Funds (Mutual Funds) |

Passive mutual funds that track an index (e.g., DAX, S&P

500) and mirror its performance.

|

Transparent and understandable. |

| ETFs (Exchange-Traded Funds) |

Passive funds tracking an index’s performance, traded on

the stock exchange.

|

Transparent and understandable. |

| Active Mutual Funds |

Funds following the strategy of a fund manager, often

involving high fees.

|

Often not transparent, strategy difficult to follow.

|

| Options (Derivatives) |

Right to buy a security (e.g., stock) at a specific time

and price. Originally for professional investors to

hedge risks.

|

Transparent but complex. |

| Futures (Derivatives) |

Forward contract to buy/sell an underlying asset at a

fixed price and date.

|

Transparent but complex. |

| Warrants (Structured Products) |

Certified options. |

Very intransparent, complex. |

| Certificates (Structured Products) |

Debt instruments with derivative components. |

Very intransparent, complex. |

Why Is It Important to Build Wealth Through Profitable

Investments?

For many years, savers received little or no interest on their

bank deposits. In some cases, negative interest rates were even

applied to savings. This changed in 2022 when the European

Central Bank (ECB) initiated a shift in interest rates by

Allianzg key rates. Since then, interest rates on typical bank

deposits—such as savings and fixed-term accounts—have risen.

Despite a first rate cut in June 2024, attractive rates are

still available.

However, money held in savings accounts continues to lose

purchasing power due to inflation. In 2024, inflation in the

Eurozone remains elevated, although lower than the peaks of

previous years. This means that non-interest-bearing balances

are still losing real value. To counter inflation, it may be

worthwhile to consider alternative investments such as

securities.

More about investing in ETFs

What Does Diversification in Investing Mean?

Diversification means spreading your investments across

different asset classes to reduce risk. By dividing your wealth

between ETFs, fixed-term deposits, and savings accounts, you can

protect yourself from major losses and make the most of your

investments. This strategy is particularly beneficial when

assets develop differently in value. Investors can also benefit

by offsetting potential losses with gains elsewhere.

Costs of Investing

The cost of investments can reduce overall returns. That’s why

comparing fees can help optimize results. While savings and

fixed-term accounts are usually free of charge, equity funds

often incur high management fees. Choosing lower-cost ETFs

instead of individual stocks or actively managed funds can help

minimize these expenses.

What Is the Best Investment Duration?

For equity funds or ETFs, the duration of the investment is

crucial in limiting or avoiding potential losses. A long-term

horizon is often beneficial for such investments. Even if

markets decline, there is a better chance of recovery over time.

When choosing the best investment, it's important to decide

whether a short-, medium-, or long-term horizon is suitable.

Investments up to 3 years are considered short-term, up to 10

years medium-term, and anything beyond that long-term.

Short-Term Investment: What Are My Options?

Short-term investments are characterized by short notice

periods, giving investors quick access to their funds. These

types of investments are often used to temporarily park unused

money before committing to long-term investment strategies. They

are also suitable for building an emergency reserve. It is

generally recommended to keep an amount equivalent to three

months' salary as a reserve to stay liquid in unforeseen

situations. Common short-term investment options include savings

accounts and fixed-term deposits with short durations. Savings

accounts are highly liquid, allowing deposits and withdrawals at

any time. They are also considered relatively low-risk, as

balances are protected up to €100,000 per person and bank under

the EU-wide deposit guarantee scheme.

What Are the Options for Medium-Term Investments?

-

Medium-term investments are ideal when you already know

you'll need the money at a specific time—for example, when

saving for a major purchase.

-

Fixed-Term Deposit: A fixed deposit for 3

or 5 years allows you to invest money until it is needed.

This option is protected by the deposit guarantee scheme up

to €100,000 per person and bank.

-

Savings Plans: These can also be considered

suitable for medium-term investment goals.

Overview of Long-Term Investments

-

Long-term investments are often used to build additional

retirement savings.

-

ETFs: Investing in stocks, equity funds,

and ETFs is common. A long investment horizon helps offset

potential losses and maximize returns. Holding onto

investments longer increases the chance of benefiting from

market upswings and reducing the risk of losses at the time

of sale.

-

Private Equity: Investing in non-publicly

traded equity can also yield attractive long-term returns.

How do you find the best investment?

When deciding how best to invest your money, the so-called Magic

Triangle of Investing can be a helpful guide. Each investment

option can be placed within this triangle, which represents the

three core criteria of investing: security, liquidity, and

profitability. These are the key and comparable attributes of

all investments. Depending on the characteristics of a specific

investment, it can be positioned accordingly. For example,

aiming for high returns usually requires accepting higher risk.

Conversely, investors seeking more security may have to accept

lower returns.

The triangle offers a simplified model of investment

characteristics. The goal is to determine your own position

within it and to find a suitable mix of different investments

that reflects your personal risk-return profile.

Examples of the classification of different investment types:

-

Savings Accounts: Positioned between

security and liquidity.

-

Fixed-Term Deposits: Found closer to the

security corner of the triangle.

-

Stocks, Funds, and Low-Cost ETFs: More

difficult to categorize as they depend on diversification,

duration, volatility, and return potential. Key factors

include your risk tolerance, available capital, goals,

investment horizon, and financial needs.

Determining Risk Tolerance

Most investors desire the best possible investment with no risk,

but high interest and strong returns. However, all investments

involve risk—especially equity funds, securities, and index

funds. Since market trends cannot be predicted, it is important

to only invest money that can be set aside for the full

investment period.

Many providers of equity funds and ETFs use historical data and

past performance to calculate volatility, or the degree of

fluctuation. While these figures can help guide investors, it is

essential to understand that past performance is not a reliable

indicator of future results. Investors can also adjust their

portfolio to match their personal risk tolerance—for example, by

selecting an ETF portfolio with a lower proportion of equities.

Choose your ETF portfolio now

Define Your Goals and Capital Needs

To find the most suitable investment, it's important not only to

determine your risk tolerance but also to define clear goals,

financial needs, and investment horizon. If you're saving for

retirement, a long-term investment may be appropriate. For

investors who know they will need the capital in a few years, a

medium-term investment may be more suitable. Ultimately, the

expected return is also a key consideration when selecting an

investment strategy.

Review Available Capital

To determine the best investment strategy for your individual

situation, it’s important to assess your total wealth. Investors

should have a clear overview of how much money they need each

month. It is also advisable to set aside a sufficient emergency

reserve—typically around three months’ salary.

Those who still have loans to repay and access to a larger sum

in the short term may consider using that money for a special

repayment before investing. Since interest on debt generally

exceeds any possible investment return, this can be a smart

financial move.

The Top Five Financial Insights Among Germans

What financial decisions have people in Germany made, and what

lessons have they learned? In a representative survey conducted

by Civey, 2,500 individuals were asked which financial insights

they plan to follow in the future.

-

Relying on Qualified Advice: The top

financial insight among Germans is the realization that

14.70% of citizens previously relied on less qualified

financial advice. Lacking personal financial knowledge can

be compensated with the right guidance that focuses on real

investment goals rather than empty promises.

-

Fulfilling the Dream of Homeownership: Amid

housing shortages and rapidly rising rents, 13.90% of

respondents regret not having invested in property or

building a home.

-

Factoring in Risk When Investing in Stocks or

Crypto:

Over one in ten (11.10%) reported having experienced losses

due to risky investments such as stocks or cryptocurrencies.

These risks should always be considered before investing.

-

Setting Aside Savings: Financial reserves

can protect against falling markets. 10.30% of Germans have

come to understand that savings are an essential foundation

for financial security.

-

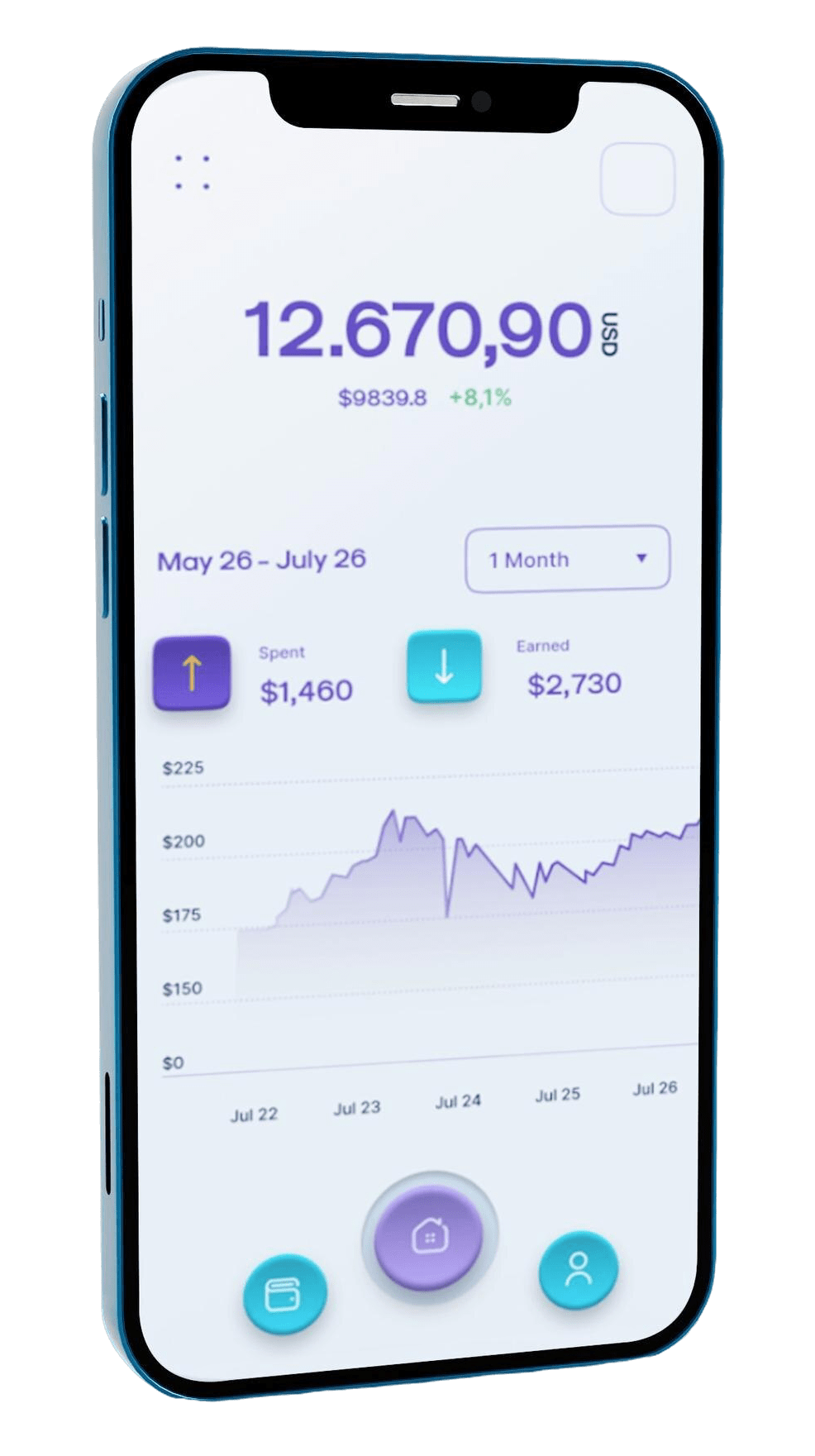

Keeping Track of Income and Expenses: For

9.00% of citizens, the most important insight is to avoid

overdraft usage in the future. Those who manage to keep

their spending below their income and avoid interest charges

can begin building wealth.

Using ETFs as an Investment with Allianz

Every investor can determine the best investment strategy based

on their personal circumstances, investment horizon, and

financial goals. Allianz offers options for different investor

types to build wealth with attractive return opportunities.

Sign In

Global and Diversified Portfolios

The portfolios in our digital wealth management platform

invest your capital in a broadly diversified way. This means

you benefit from global equity and bond markets through a

single portfolio.

Our investment team follows a strategy based on insights

from 50 years of leading financial research.

Learn more about the investment strategy >